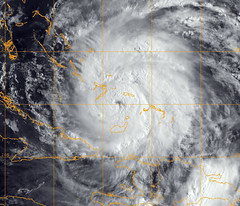

Insurance adjusters aren’t wasting any time trying to assess the damage caused by Hurricane Irene. It has been noted that there is more flooding than expected. Overall, at this point in time, Irene has done less damage than other hurricanes have caused.

Insurance adjusters aren’t wasting any time trying to assess the damage caused by Hurricane Irene. It has been noted that there is more flooding than expected. Overall, at this point in time, Irene has done less damage than other hurricanes have caused.

So far, insurance adjusters, who have been keeping a close watch on the total amount of damage caused by Hurricane Irene, say that the damage is about what they expected it would be. People who work as insurance adjusters are the ones whose job it is to investigate insurance claims, and claims for damages. They are the people who end up deciding what an effective settlement will be for each individual claim.

According to Eqecat, a company that is a “catastrophe modeler”, Hurricane Irene has caused around $1.1 billion in insured losses in the Caribbean, (so far). It has been projected that there could be as much as $10 billion in loss reported before Hurricane Irene leaves the East Coast. This, of course, will depend largely on what path the hurricane takes.

Catastrophe modelers have noted that so far, Hurricane Irene has caused less damage in North Carolina and Virginia than hurricanes that have hit those states in the past. Hurricane Floyd, which hit in 1999, has been called one of the 15 costliest hurricanes ever, according to the National Hurricane Center. Hurricane Fran, which hit in 1996, also caused more damage than Hurricane Irene did, (for those states).

Insurance adjusters believe that Hurricane Irene is going to cause more flood damage than they anticipated. This could be very problematic, financially speaking, for the federal government.

Most of the flood insurance policies that are purchased by Americans are written by the National Flood Insurance Program. Right now, lawmakers in Washington are trying to find ways to cut the deficit. The money that must be paid out on flood claims could be difficult to come up with.

One of the states that will likely be affected by flooding damage is New York. Weather forecasters from the ABC affiliate in New York have said that the storm surge from Hurricane Irene could be between 5 and 8 feet. It is expected that this could, potentially, hit New York City.

The National Flood Insurance Program is one that sells flood insurance policies across the United States. At the end of June 2011, New York had around $8.61 billion of flood insurance from the NFIP program. Around 38,000 policies are within New York City itself.

Image by Official U.S. Navy Imagery on Flickr